Coca-Cola cans and bottles from the Palestinian Authority,

Jordan, and Iraq have appeared in Israeli stores, attracting customers with

their small, nostalgic sizes and low prices. However, these products lack

Hebrew labelling and kosher certifications, raising legal and health concerns

in Israel.

What is the news about Coca-Cola cans from these regions selling in Israel?

As reported by Ynet's investigative report, small Coca-Cola

cans and bottles sourced from the Palestinian Authority, Jordan, and Iraq have

begun appearing in convenience stores and kiosks across Israel. These packs,

notably smaller than standard Coca-Cola sizes and reminiscent of in-flight

beverages, are catching consumers' attention because of their affordability and

nostalgic appeal. The mini cans and bottles are available in sizes of 100 ml

(3.38 fl oz) and 150 ml (5.07 fl oz).

How do pricing and consumer preferences influence this trend?

A Jerusalem resident interviewed by Ynet noted,

"Israelis always look for cheaper alternatives, even if the taste isn’t always the same."

In East Jerusalem, these small cans may be sold for as

little as one to one-and-a-half shekels (approximately $0.27 to $0.40),

compared to standard Coca-Cola products which retail at around 3.90 shekels

($1.05) or more in central Israel. Popular supermarkets offer promotions such

as three cans of 330 ml Coca-Cola for 10.90 shekels ($2.94), whereas prices in

restaurants or cooled kiosks can reach up to 12 shekels ($3.24).

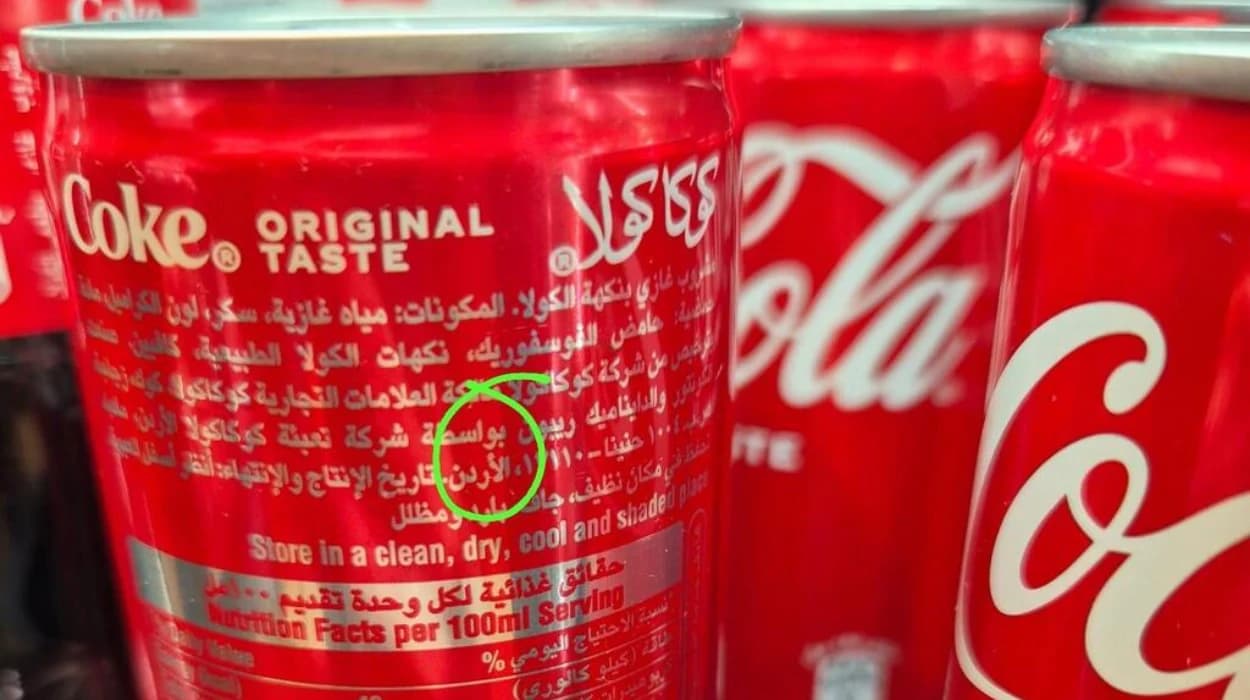

What do these cans look like and where are they produced?

Ynet found 100 ml Coca-Cola Zero and 150 ml Coca-Cola cans

labelled as produced in "Beitunia, Palestine." Jordanian bottles and

cans were also identified, along with a 150 ml can from Erbil, Iraq. These

products are sold alongside standard Coca-Cola Israel products but are visually

distinct due to their smaller sizes, lack of Hebrew labelling, and different

ingredient lists.

Are these products legally compliant in Israel?

The Consumer Protection and Fair Trade Authority in Israel noted that the sale of these products may violate Israel’s Consumer Protection Law. The law requires proper Hebrew labelling, including manufacturer identity, product name, and quantity details. These mini cans do not have Hebrew labelling or kosher certifications, and they are not eligible for deposit returns. Ingredient differences in cans from Jordan and Iraq were highlighted, with some substances absent in Coca-Cola Israel’s standard offerings. One major retail chain stated,

“We’re constantly offered Coca-Cola from the Palestinian Authority by wholesalers in Tulkarm and Bethlehem, but we couldn’t secure health approvals.”

A store named Boutique Central admitted that a private

initiative by a franchisee led to the sale of these products, which were

promptly removed once the issue was raised.

What are the broader implications of this import trend?

This influx of non-standard Coca-Cola cans reflects a

broader trend of Israelis seeking budget-friendly product options amidst rising

living costs. However, the lack of transparency regarding the origin and

product details, coupled with concerns over missing kosher certifications,

introduces health, legal, and ethical questions. Retailers and consumers alike

face challenges in navigating options, balancing price sensitivities with regulatory

compliance and product quality considerations.

What is the historical context of Coca-Cola and its presence in these regions?

Coca-Cola has a complex history in the Middle East.

According to a 2024 Deseret report, Coca-Cola returned to the Jordanian market

after the Arab boycott, related to the company’s business dealings in Israel,

began to fizzle out in the early 1990s. This shows a gradual reopening of

markets despite longstanding political tensions.

In Iraq, Coca-Cola products are usually imported from

Jordan, Turkey, and other neighbouring countries, as revealed by a Reddit

discussion on the boycott in Iraq. Pepsi Cola had dominated the Iraqi market

during the mid-1960s boycott of companies linked to Israel. However, Coca-Cola

continued to find ways to penetrate the market indirectly.

What controversies surround Coca-Cola and its operations related to Israel and Palestine?

Coca-Cola’s operations have been criticised by Palestinianrights activists and boycott campaigners. According to a 2021 report by FOA

(Friends of Al-Aqsa), Coca-Cola operates in Atarot, an illegal Israeli

settlement built on Palestinian land in the occupied West Bank, violating

international law. The Palestinian-led Boycott, Divestment, and Sanctions (BDS)

movement particularly targets Coca-Cola for its complicity in the occupation

and apartheid against Palestinians.

A 2024 investigation by bdsmovement.net highlighted

Coca-Cola Israel’s regional distribution centre and cooling houses in the

Atarot Settlement Industrial Zone. The International Court of Justice has

confirmed the illegality of Israeli occupation and settlements, branding such

business operations as potentially complicit in war crimes.

Are there alternative local products responding to this political and commercial climate?

Palestinian and Jordanian markets have seen increased demand

for local soda brands amid calls to boycott Western companies supporting

Israel. For instance, Chat Cola in the West Bank, as covered by Arab News and

Reuters, has grown in popularity following the recent Gaza conflict, with

packaging and flavours designed to rival Coca-Cola. Chat Cola even secured

kosher certification to appeal to a wider market, including Arab communities in

Israel.

Jordan's Defaf Al-Nahrayn Company’s Matrix Cola has expanded

its distribution due to growing local appetites for alternatives to Western

brands like Coca-Cola and Pepsi, driven by political boycott sentiments.

What does the future hold for Coca-Cola and similar products in this region?

The ongoing political dynamics and consumer boycotts in the

Middle East point to a challenging path for global brands such as Coca-Cola.

The appearance of unregulated cans from Palestinian Authority, Jordan, and Iraq

in Israeli markets is both a symptom and a catalyst of wider economic, legal,

and political conversations. A growing preference for affordable, local, and

ethically produced beverage options is reshaping the soda market in the region.

Retailers must navigate Israeli consumer protection laws while

responding to price sensitivities, and consumers weigh taste, price, and

political considerations when choosing products.