Washington (The Palestine Telegraph Newspaper) 24 January 2026 – US President Donald Trump threatened to impose 100 per cent tariffs on Canada if Ottawa pursues a trade deal with China. He warned Canadian Prime Minister Mark Carney against allowing Canada to become a 'drop-off port' for Chinese goods entering the US market.

The statement came during a White House press conference addressing North

American trade relations. Trump reiterated commitment to USMCA renegotiation

terms amid rising tensions with Beijing.

President Trump made the remarks on 23 January 2026 during a

45-minute press conference in the White House Rose Garden. He specifically

addressed reports of Canada-China trade talks scheduled for February 2026 in

Vancouver. Trump stated that any agreement facilitating Chinese imports through

Canada would trigger immediate tariff action. White House Press Secretary

Karoline Leavitt confirmed the policy position applies to steel, automobiles,

and consumer electronics.

The warning follows Canada's December 2025 decision to

explore comprehensive economic partnership with China despite US opposition.

Canadian Trade Minister Mary Ng confirmed exploratory discussions covering

agriculture, minerals, and technology sectors. Trump administration officials

expressed concerns over transshipment practices circumventing US Section 301

tariffs on Chinese goods.

Context of Trump's Tariff Announcement

Credit: Alex Brandon/AP

President Trump spoke after a National Security Council briefing on Chinese trade practices. He referenced 2025 Commerce Department data showing $15 billion in Chinese steel rerouted through Canadian ports. The US collected $2.8 billion in tariffs on such transshipments last year. Trump directed US Trade Representative Jamieson Greer to prepare tariff schedules targeting Canadian exports.

Canada exported $450 billion to the US in 2025 under USMCA

rules of origin. Key sectors include crude oil (45 per cent), vehicles (15 per

cent), and lumber (12 per cent). Trump specified 100 per cent duties would

apply to non-USMCA compliant goods, potentially affecting 30 per cent of

bilateral trade. Commerce Secretary Howard Lutnick confirmed implementation

within 30 days of any Canada-China pact signature.

The threat aligns with Trump's 6 January 2026 executive

order strengthening border enforcement against tariff evasion. US Customs and

Border Protection increased inspections at Detroit-Windsor and Buffalo-Fort Erie

crossings by 25 per cent. Canadian Chamber of Commerce reported $800 million in

delayed shipments since implementation.

Canadian Government Response to US Warning

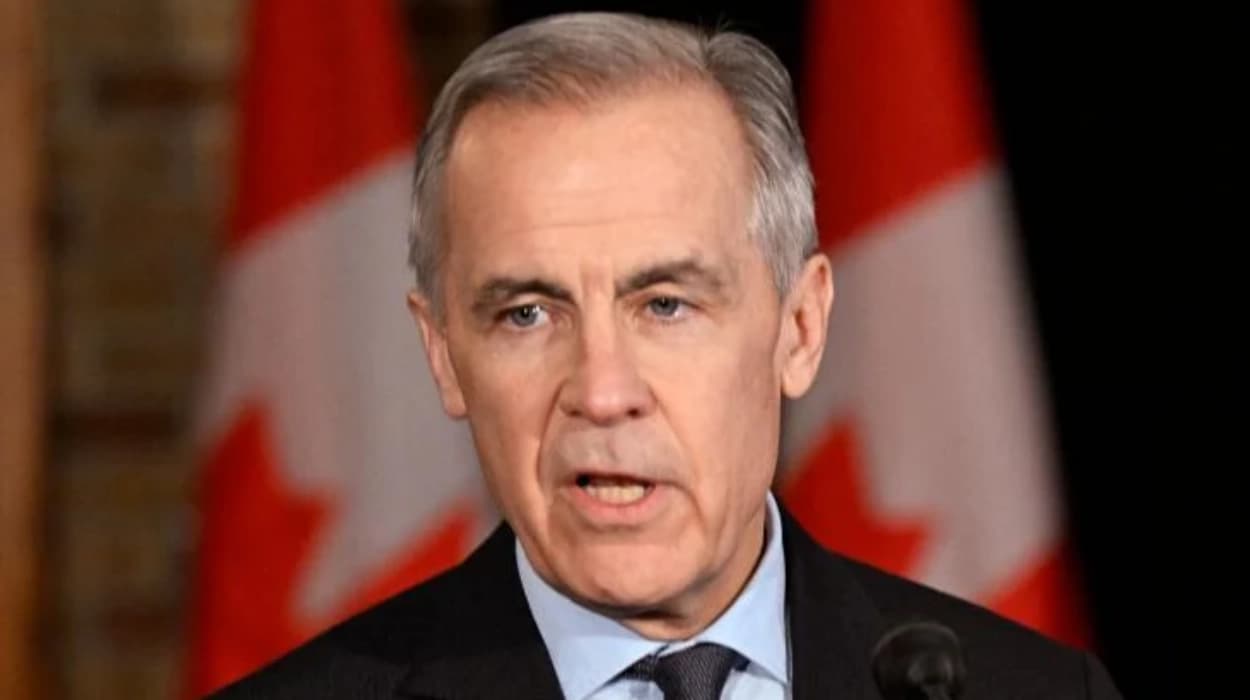

Prime Minister Mark Carney addressed the issue during

Question Period in Ottawa on 23 January 2026. Carney stated Canada pursues

sovereign trade policy while honouring USMCA commitments. He noted ongoing

trilateral consultations with US and Mexican counterparts. Trade Minister Ng

scheduled a call with Greer for 25 January to clarify positions.

Canadian Foreign Minister Mélanie Joly emphasised

diversified partnerships reduce reliance on single markets. Canada-China talks

focus on critical minerals cooperation, with China supplying 80 per cent of

refined graphite. Joly confirmed no discussions on transshipment arrangements

or tariff circumvention. Global Affairs Canada released a fact sheet detailing

$12 billion in two-way trade with China last year.

Opposition Conservative Leader Pierre Poilievre criticised

Carney's approach, calling for suspension of China talks. Bloc Québécois leader

Yves-François Blanchet advocated provincial autonomy in resource exports. New

Democratic Party urged tariff exemptions for clean energy components.

Details of Reported Canada-China Trade Talks

Vancouver will host preliminary negotiations 10-12 February

2026 between Canadian and Chinese trade delegations. Agenda items include

tariff reductions on canola, seafood, and pork exports. China seeks

preferential access to Canadian lithium and nickel for EV batteries. Canadian negotiators

demand improved market access for beef and dairy products.

China Commerce Minister Wang Wentao proposed zero tariffs on

95 per cent of industrial goods. Canadian officials seek commitments on

intellectual property enforcement and forced labour bans. Both sides target $25

billion annual trade volume by 2030. Previous talks stalled in 2024 over Huawei

5G exclusion.

China represents Canada's second largest trading partner

after the US, with $105 billion in goods exchanged in 2025. Key Canadian exports

include potash, aircraft parts, and wood pulp. Chinese imports comprise

machinery, electronics, and pharmaceuticals. Trans-Pacific Partnership

withdrawal in 2017 halted formal FTA negotiations.

USMCA Framework and Renegotiation Timeline

Credit: piie.com

USMCA, effective since July 2020, sets 75 per cent regional

content rules for automobiles. Trump seeks revisions strengthening North

American supply chains excluding China. Mexico agreed to similar tariff threats

in December 2025 regarding Chinese steel dumping. USMCA review scheduled for

July 2026 under Article 34.6 provisions.

United States Trade Representative office monitors 500

Canadian firms for China sourcing. Violations trigger 25 per cent penalties

under existing rules. Greer testified before Senate Finance Committee that

Canada compliance rates dropped from 92 per cent to 85 per cent since 2024.

USMCA dispute panels resolved 18 cases last year.

Mexican President Claudia Sheinbaum confirmed trilateral

summit planning for March 2026 in Mexico City. Agenda prioritises energy

integration and migration controls alongside trade barriers.

Economic Impact Assessments

US Chamber of Commerce projected 100 per cent tariffs would

raise Canadian vehicle prices 18 per cent in US markets. Ontario auto sector

employs 120,000 workers producing 1.8 million vehicles annually. Petroleum

Service Association warned gas prices could rise 25 cents per litre at Canadian

pumps.

Canadian Manufacturers & Exporters estimated 80,000 job

losses from full tariff implementation. Bank of Canada Governor Tiff Macklem

noted potential GDP contraction of 1.2 per cent. Fraser Institute calculated

$14 billion annual cost to Canadian households.

China Daily reported Beijing prepared retaliatory tariffs on

US agricultural goods routed through Canada. People's Daily criticised US

protectionism hindering global recovery. Chinese embassy in Ottawa reaffirmed

commitment to rules-based trade.

Previous Trump Tariff Actions Against Canada

Trump imposed 25 per cent steel and 10 per cent aluminium

tariffs on Canada in June 2018, lifted July 2019 after USMCA signing. 2020

lumber duties reached 24.1 per cent before appellate review. Section 232

national security tariffs collected $1.2 billion from Canadian exporters.

2025 softwood lumber dispute resulted in 14.5 per cent

duties on $9 billion exports. Dairy quota violations prompted 2024 USMCA panel

ruling favouring US farmers. Trump administration won 12 of 15 trade disputes

with Canada through 2025.

Commerce Department verified 200 Canadian firms

transshipping Chinese solar panels in 2024. Penalties totalled $450 million

with import bans on 35 companies.

Official Statements from Key Figures

President Trump stated:

"Canada cannot become a drop-off port for Chinese goods entering the US market. 100 per cent tariffs will protect American workers."

Prime Minister Carney responded:

"Canada determines its sovereign trade relationships while respecting

USMCA obligations."

Trade Representative Greer added: "Any facilitation of

Chinese tariff evasion through Canada triggers immediate countermeasures."

Chinese Foreign Ministry spokesperson Lin Jian noted: "Trade cooperation

with Canada follows WTO rules without targeting third parties."

White House economic adviser Kevin Hassett projected tariff

revenue funding infrastructure. Canadian Finance Minister Dominic LeBlanc

scheduled G7 finance ministers call addressing spillover risks.

Broader US-China Trade War Context

Credit: internationaltradeinsights.com

US Section 301 tariffs cover $370 billion Chinese imports averaging 19 per cent rates. 2026 tariff hikes target semiconductors, EVs, and steel products. Commerce restrictions block 150 Chinese firms from US markets. Export controls limit advanced chip technology transfers.

Canada faced secondary sanctions pressure after 2025 Huawei

CFO extradition completion. Ottawa banned Chinese apps from government devices

in December 2025. Australian model influenced Canadian critical infrastructure

protections.

European Union imposed

mirror tariffs on $28 billion US goods in retaliation for steel duties.

Japan negotiated exemptions through US-Japan Trade Agreement Phase One. India

faces 2026 review of $1.3 billion tariff reductions.

North American Supply Chain Implications

Automotive sector sources 35 per cent components from China

through Canadian suppliers. Ford, GM, and Stellantis report $2 billion annual

cost increases from potential tariffs. Great Lakes shipping carries 15 per cent

Chinese steel transshipments.

Alberta oil sands exports face pipeline capacity constraints

exacerbated by trade uncertainty. Enbridge Line 5 dispute resolution delays

Canadian crude deliveries. US Midwest refineries process 70 per cent Canadian

heavy oil.

Clean energy transition complicates tariff calculations. Canada supplies 60 per cent US lithium imports via Chinese processing partnerships. Quebec hydroelectric exports power 20 million US homes under long-term contracts.